- Daily & Weekly newsletters

- Buy & download The Bulletin

- Comment on our articles

Taxing times 2016: Understanding the codes in Belgian income tax return (part 5)

When you look at your tax return, you will see that it is split up in boxes depending on the topic. In box I you declare your telephone number and your bank account if you expect a reimbursement. Box II is for your personal information, your marital status, and the dependents you want to claim. In box III, you declare the income from any real properties you may own. If you only own the house you live in, you don’t need to declare anything, but if you have a second residence or if you own a rental property, you need to declare the cadastral revenue.

I have an apartment that I rent out

Then you must find the cadastral revenue (it is on the real property tax bill (the précompte immobilier/roerende voorheffing). If you own it together, you declare half in your column and half in the column of your spouse or partner (codes 1106 and 2106). As you will see, I just mention the short codes because the last two figures are just a validation number. The first number indicates the first and second column. That cadastral revenue will be multiplied with 1.4 and corrected for inflation. Roughly speaking you will pay tax on 2.2 times the cadastral revenue.

If the tenant is a company or someone who uses it for his profession (e.g. a physician or an accountant), you must declare the rent you receive and you will pay tax on the that rental income minus a deduction of 40% (however, that deduction is limited to 2.82 times the cadastral revenue).

And property abroad?

If you own property abroad, you need to declare that as well (normally in codes 1130 and 2130). If you receive rent, you need to declare the rent, but if you don’t (e.g. because it is a second residence), you need to declare the rental value, that is the rent you would normally receive from a tenant.

You cannot take any deductions for expenses, but the tax authorities will deduct 40% automatically. Nevertheless, you can The rent or the rental value are only taxable in the country where the property is situation, but it will push up the tax rate on your other income.

I only have my earnings

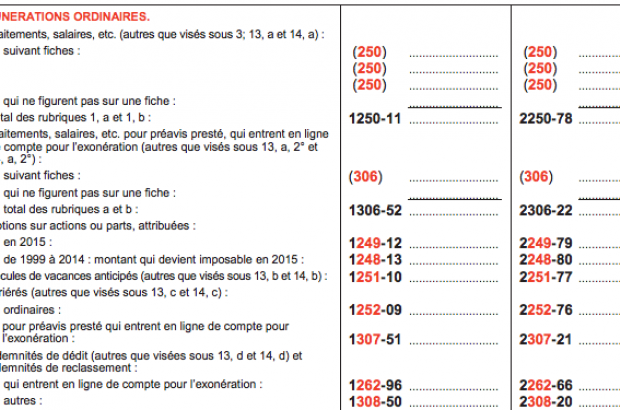

Then you have to look at box IV. Box IV will be of importance for most people. It relates to your salary and the tax withheld by your employer. You will see that your salary statement shows the code 250 to the left of your salary and 286 next to the tax. The numbers must then be copied under code 1250 and 1286 (for the husband) and 2250 and 2286 (for the wife).

If you have received any specific form of salary, e.g. an indemnity in lieu of notice, or stock options, you will see that they have a different code that corresponds to these will be reported on your pay slip with the relevant code on the tax return.

If you have been working outside Belgium and if that income is taxable in the other country, you must include that income in your tax return, but you must mention that at the end of box IV under letter O. It is required to add a note to your tax return to explain for what reason the income is taxable in the country where you worked, e.g. mention the article of the double tax treaty.

I am retired

Box V is for pensions. The pension will go in code 1228 or 2228 and the tax that has been deducted goes in code 1225 or 2225. If there are special forms of pension, the pay slip issued by a Belgian organisation will clarify the code. If you are living in Belgium and receive a pension that will normally be taxable in Belgium. However, in certain situations, the double tax treaty signed between Belgium and the country from where the pension is paid may state that the pension is taxable in the other country and that Belgium must exempt it. If so, you must mention that at the end of box V under letter C.

And if I receive maintenance?

In Belgium, if you pay maintenance, you can deduct 80% (see Box VIII). If you receive maintenance, you must declare it in Box VI and you will be taxed on 80% of the maintenance. In both cases you need to identify the person who receives or pays the maintenance.

Interest and dividends

Box VII is for the income of your investments, i.e. dividends and interest. These are normally taxed by way of a deduction at source; the (Belgian) bank deducts 25% when it pays the dividend or interest. However, if you receive dividends or interest on a bank account outside Belgium, you must report the income, and usually that will be under code 1444 or 2444. If you received interest on a savings account within the European Economic Area, you do not have to declare that unless the interest is over €1,880 per partner or per spouse. If it is higher, then you put the difference in code 1151 or 2151 ; it will be taxed at 15%.

We have bought our house

In box IX you mostly report interest and mortgage payments to buy your main residence (letter B) or another property (letter C). As you will see, the codes relating to your main residence start with a 3 or a 4. That is because the legislation is not federal but regional, and varies depending to whether you live in Flanders, Wallonia or the Brussels Capital region.

Other tax reductions

Box X is for all sorts of payments or expenses that you have made and for which you can claim a tax reduction. That goes from donations to charities (1394), child care (1384), pension saving (1361/1362), “titres services” (3364/4364) and investments to make your house energy efficient or more secure.

Paying your tax in advance

If you have paid your tax in advance, e.g. because you do not have an employer who deducts the tax from your salary, you report that under 1570 or 2570 in Box XII. Paying the tax in advance is highly recommended, in particular for self-employed.? Not doing so results in a tax increase of 1.125% (that is relatively little, it used to be much more when the interest rates were much higher).

If you received interest from Luxembourg or Switzerland

Box XIII relates to the 35% withheld on the interest you have received in countries like Luxembourg or Switzerland where you were able to keep your accounts anonymously. These countries did not report the interest to Belgium but deducted 35% and paid three quarters to Belgium on an anonymous basis. However, it is a common misunderstanding that if you paid this 35% tax that you do not have to report the interest anymore. You still have to declare the interest under code 1444 or 2444, pay 25% and you can recover the 35% under codes 1555 or 2555.

Ah, the bank accounts!

Finally, in box XIV you are asked to confirm that you have bank accounts outside Belgium ; that links in with the obligation to report these to the National Bank. You also report that you have overseas life insurance (which is usually not taxable). Moreover you have to confirm that you have set up a legal arrangement (a “construction juridique”) or that you are the beneficiary of such a legal arrangement. That is any structure like a trust, a foundation, a foreign company in which you accumulate income tax free. If you have, you will have to declare the interest and dividends that accumulated in this legal arrangement. That is called the Cayman tax.

And finally

When you are finished, all that is left to do is transfer the information to the pink tax return, put a date on it and sign it. You do not need to file the document préparatoire with your notes. Do not forget to put the tax return back in the brown envelope, put a stamp on it and talk a walk to the post office.

Marc Quaghebeur is a lawyer and partner at De Broeck, Van Laere & Partners. More information at www.taxation.be

Comments

Where can I find an English version of the tax form ?