- Daily & Weekly newsletters

- Buy & download The Bulletin

- Comment on our articles

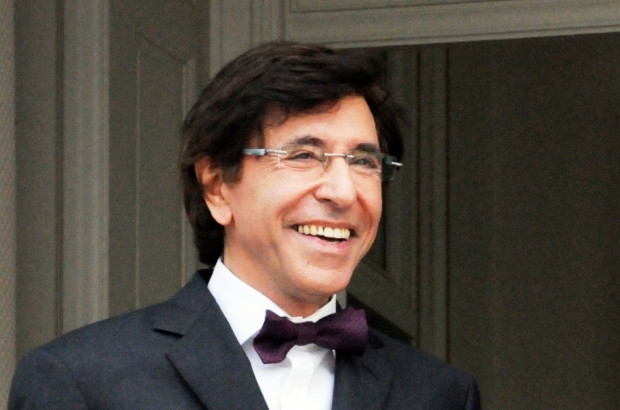

PM to introduce new concept to royal family: paying tax

Prime minister Elio Di Rupo has submitted to the Committee for the implementation of institutional reforms (Comori) a list of proposals aimed at overhauling the way stipends are awarded to members of the royal family. Among the more eye-catching proposals is the introduction of tax and VAT on royal allowances. In accordance with recommendations made by the Senate in July 2009, the only members of the royal family to receive allowances would be the King or Queen’s surviving spouse, the heir or heiress to the throne and their spouse, and a King or Queen who stood down. Under the prime minister’s proposals, any allowances granted would be incompatible with other remunerated positions. Members of the royal family would also be subject to tax - whether it be income tax, excise or VAT -, from which they are currently exempt, and most of their allowances would be subject to supervision by the first President and the President of the Court of Auditors.

The allocation of official accommodation would only be limited to certain members of the royal family: the King and Queen, the Crown Prince or Princess, the surviving spouse of a deceased sovereign and any sovereign who has stood down. A transitional provision would be made for Prince Laurent and Princess Astrid to keep their allowances as well as their houses but they would be required to comply with a code of ethics. The committee has noted the proposals, but no agreement was reached on Monday. A new version including comments made by all parties concerned is expected soon.