- Daily & Weekly newsletters

- Buy & download The Bulletin

- Comment on our articles

From the East: Wallonia is fast becoming the gateway between China and Europe

Wallonia’s perseverance in forging stronger ties with China is paying off. Liège will become the European gateway of Chinese e-commerce giant Alibaba in 2021, as Belgium becomes the first European country to sign up to Alibaba’s e-commerce initiative to make global trading easier for small companies.

Alibaba has been dubbed the Asian equivalent of Amazon and eBay rolled into one. Financial analysts consider it one of the largest and most valuable e-commerce companies in the world, but in terms of revenue, its annual profit calculated for 2018 at €35.1 billion came in at just around 21% of Amazon’s.

The group’s logistics arm, Cainiao, has leased a 220,000 square metre site at Liège Airport and handed over an initial sum of €75 million to develop a European distribution centre, to begin operating in 2021. It will create 900 direct jobs and about 2,000 indirect jobs and will serve as a ‘Gateway to China’ for international companies while importing €176 billion worth of quality goods to China over the next five years.

“It’s quite clear Alibaba is coming to compete with Amazon,” says Michel Kempeneers, inspector-general for oversees export and investment at the Wallonia Export and Foreign Investment Agency (AWEX). “It will increase the export opportunities for companies in Wallonia – especially SMEs and very small companies, they can be more international and avoid having exclusive partnerships with Amazon.”

The Liège deal is the cornerstone of a greater Alibaba initiative to reduce the barriers to international trading with China faced by small and medium-sized enterprises in countries that Alibaba would like to expand into. It wants to work with governments on a host of measures including mobile payment services, lowering tariffs and speeding up customs clearance on both sides.

Called the Electronic World Trading Platform (eWTP), the initiative was conceived by Alibaba founder Jack Ma in 2016 amid worsening trade wars between China and the US, and has high visibility in the G20 group of countries. Platforms in Malaysia and Rwanda are already under way, with Alibaba planning others in Russia and the United Arab Emirates.

Belgium beat the Netherlands to become the lead European gateway, with the official signing of a memorandum of understanding between the federal government and Alibaba on 5 December. It was overseen by prime minister Charles Michel, who called it “a huge opportunity to boost exports and bring wide-reaching economic benefits to society, including employment opportunities to Liège”.

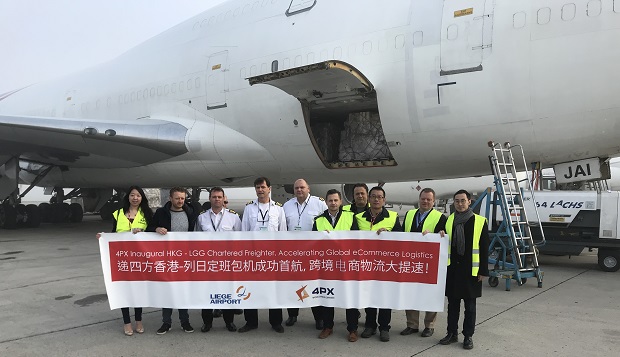

Significantly, Liège was strategically placed to fit into this initiative with the creation of an EU-China Logistics incubator earlier in the year, using Liège Airport as a base. The first of its kind in Europe, the incubator was set up by AWEX, Liège Airport, and Logistics in Wallonia, to support Chinese companies wishing to do business in Europe by providing cross-border e-commerce services such as easy access to logistics and transportation companies.

The latest developments with Alibaba follow hot on the heels of the creation of the China-Belgium Technology Center in Louvain-La-Neuve, expected to be operational in 2020, and electric car maker Thunder Power moving its assembly line to Gosselies, near Charleroi (see sidebars).

Kempeneers says he and his teams in Brussels, Namur and China have been working to put Wallonia on the map with big Chinese companies for the last five years or so. “We went for big fish, because we know that if we fish for a big fish from the start, a lot of little fish will follow,” he says.

A case in point is the new Chinese freight train line between Zhengzhou and Liège, which was inaugurated in October. The company ZIH already had two lines from Zhengzhou to the German cities of Munich and Hamburg and was looking for a third European destination. Although a rail link from Liège to Zhengzhou was first suggested during a 2013 Wallonia development mission to Henan province, ZIH didn’t commit to Liège until Alibaba announced Liège Airport as its European hub in 2018. Fired by a German private locomotive, the train now travels 11,000 km from Liege to Zhengzhou twice a week, bringing goods from central China through Russia to Europe, and taking consolidated exports from Belgium, France and the west of Germany. They include Belgian beers and chocolate, auto parts, baby food and pharmaceuticals.

The train line is an example of low-risk Chinese investment in Wallonia that Kempeneers describes as “non-critical and non-dangerous,” comprising goods and passengers coming to Europe. “They will make their way to Europe whatever the entry point. If it’s not Belgium, they’d come through the Netherlands or Germany or France, so we are very happy to welcome these goods and passengers here in Belgium,” he says. “But we also have some specific and more risky, more critical projects,” he adds, citing the €175 million deal to bring electric car company Thunder Power’s city car assembly line to Gosselies, of which €50 million came from the Wallonia regional investment fund, Sogepa.

This will create 350 jobs, which should rise to the 2,000 mark when Thunder Power moves its research centre from Milan to Gosselies following full production capacity. It’s expected to produce its first cars in 2020, to be sold at a substantially lower price than Tesla’s model S city car. “There’s a lot of competition not only from European electric car companies but also Chinese groups intending to come over to Europe because they are world leaders in this sector, so it’s a risk that we take, that the governments take, with full responsibility to say that we are not sure it will succeed but we will try. Because if we do not try we will never succeed.”

China is one of the top five international investors in Flanders, whereas 80-85% of Wallonia’s international investment outside Europe comes from the US. AWEX is trying to redress this balance. “It’s also important for us to avoid exclusivity or monoclients for exports, investors and investments in Wallonia,” says Kempeneers. “With China looking to expand its markets away from the US, Wallonia is the right place at the right time right now, to reap the benefits.”

However, the imbalance comes under scrutiny in a report by the Egmont Royal Institute for International Relations in Belgium, published by the European Think-tank Network on China (ETNC) in December, and Belgium is flagged up for not having a coherent policy on Chinese investment in Wallonia and in Flanders. The report states: “There is apparently little to no dialogue between regions on the implications of growing Chinese investment in the country, not only in economic terms but also in terms of its impact on values and influence.”

Kempeneers agrees and is keen to put forward a reason for the lack of dialogue on Chinese investments. “We are competitors so we try to have different networks. There’s clearly competition,” he says. It’s a key reason why AWEX decided to focus on relatively unexplored regions of China ten years ago, he explains.

Security issues surrounding technology companies close to the Chinese state have been cropping up in headlines across the US and Europe, since any company managing the infrastructure over which data flows could get direct access to whatever passes through its system.

Kempeneers believes opening up to China’s digital economy is a risk worth taking. “We are in the middle of Europe, we are the most open country and we are the most favourable for the investors. The Chinese are worldwide investors and market leaders now. We cannot say it’s too dangerous with the Chinese so [they should] keep out of Belgium. We cannot say that, we have to stay open.”

He also thinks Belgium is probably the safest place in Europe. “We have the Nato headquarters, the EU headquarters, and all the big international companies have some headquarters here. There’s a lot of expertise in cybersecurity, and security in terms of people, so even for the Chinese, it’s good to choose Belgium because they know we are more protected than say Greece or the Czech Republic or Poland or Portugal,” he says.

China-Belgium Technology Center

The deal: Four business incubators to promote cross-innovation between the two countries. Around 200 companies expected (100 Belgian, 100 Chinese), on a self-contained site with a hotel, conference centre and parking.

Where: An 8.5-hectare-site at Louvain-la-Neuve Science Park near the E411 motorway.

Total investment: €200 million from the entirely private Chinese United Investment Group (UIG-Europe). The investors are Hubai United Development Investment (90% shareholder) and JuXing International Technology (10% shareholder), an investment consortium of the Wuhan Eastlake International Business Incubator (Whibi) and Wuhan Technology Investment.

When: The first buildings are expected to be operational in 2020. Around 20 Chinese companies are already in an adjacent building, waiting to move in.

Jobs to be created: 1,500 (60% Belgian, 40% Chinese)

Thunder Power

The deal: The assembly of the Chloé electric city car named after the granddaughter of Thunder Power CEO Wellen Sham. Easier to build than the Sedan initially envisaged, which would have required the roof of the factory to have been lifted.

Where: Gosselies in Hainaut, at the site of the former Caterpillar heavy machinery plant, which closed in 2016 with 2,000 job losses when the US manufacturer pulled out.

Total investment: €175 million, of which €50 million comes from the region’s investment fund, Sogepa.

When: First cars expected in 2020, expected to be priced at 40% less than Tesla’s model S.

Jobs created: 350 in the first phase in 2020. Expected to rise to around 2000.

This article was first published in the Wab magazine